Advertisement

For years, people have tried to beat the stock market using instinct, research, or strategy. But today, artificial intelligence is becoming one of the most effective tools in the space. AI trading is no longer experimental; it's quietly shaping how trades are made, risks are managed, and portfolios are built. From hedge funds to everyday investors, AI is being used to analyze data, predict trends, and automate decisions. Rather than replacing people, it's giving them better information and faster reaction times in a market that doesn’t wait.

At the center of AI trading is machine learning. Unlike fixed-rule systems, machine learning adapts based on data exposure. The stock market offers huge volumes of that data: price movements, company earnings, economic indicators, social media sentiment, and breaking news. AI models bring these different sources together to spot links that would be impossible to track manually.

Instead of relying on single data points, AI creates a broader picture by processing many factors at once. A developing storm, political change, or commodity shortage can all affect the market, and AI systems can account for that faster than human analysts.

These models also improve with time. As more data is fed in, their predictions grow more refined. In markets where speed and timing are everything, the ability to adjust in real time is a major advantage.

AI’s influence goes beyond predicting stock movements—it’s changing how trades are placed. Algorithmic trading, which uses pre-set rules to execute trades, now benefits from AI’s ability to learn and adapt. These systems monitor short-term trends, volumes, and price shifts, adjusting how and when they trade based on live data.

For example, if an AI model detects that a particular stock tends to dip around mid-afternoon, it might adjust trade timing to buy at a better price. These insights come from analyzing months of detailed patterns, not just general market behavior.

In high-frequency trading, AI plays a critical role. Firms that trade thousands of times a second rely on AI to detect price discrepancies and opportunities faster than a human ever could. But the technology is useful for longer-term institutional trades too. When large investors need to buy or sell without moving prices too much, AI breaks orders into smaller trades over time, reducing cost and visibility.

This kind of execution combines speed with subtlety—something traditional trading systems can’t do without help from machine learning.

Every trader knows that reward comes with risk. One of AI’s strengths is identifying and minimizing that risk before it becomes a problem. Traditional models look at a limited set of variables. AI goes further, using deeper data analysis to predict potential losses in various scenarios.

Take a surprise policy announcement or geopolitical shift. AI systems can quickly scan global news, estimate likely impact by sector or region, and help rebalance a portfolio to reduce exposure—all in near real time. That kind of fast, multi-layered response can’t be matched by static spreadsheets or outdated models.

AI is also helping reshape portfolio construction. Instead of adjusting investments on a fixed schedule, some firms use AI to update positions daily—or more often—based on shifting market conditions. These systems don’t just look at past performance. They examine ongoing changes in sector strength, currency impact, and asset correlation.

This same logic appears in consumer tools, too. Robo-advisors use simplified AI models to manage everyday portfolios, adjusting for goals like retirement, major purchases, or lower risk exposure. While not as complex as institutional systems, they apply the same principles—continuous learning and data-driven adjustments.

Despite the advantages, AI trading isn’t flawless. Its output depends entirely on the data it receives. If that data is incomplete, biased, or misleading, the resulting decisions can be poor. Markets sometimes move based on emotion or sudden panic—things AI systems often struggle to process.

For example, unexpected events like the 2020 pandemic created market swings that many AI models didn’t foresee. These systems rely on patterns, and if the situation is entirely new, their responses may be off.

Another issue is transparency. Some AI models operate like black boxes. They make decisions based on layers of logic that even the developers may not fully understand. This makes them difficult to audit or explain, which is a growing concern for regulators and investors alike.

There are ethical concerns, too. AI trading at scale can create instability. If multiple systems react the same way to the same signals, they can trigger sharp, collective moves—sometimes leading to flash crashes or abnormal price swings. That raises the question of oversight. Should AI be allowed to make trades without any human input? Most firms agree that there should be a balance, keeping people in the loop even as AI takes on more of the workload.

Despite these issues, AI is continuing to grow in the finance world. Companies are investing in new models, hiring experts to build and maintain them, and using these tools to gain even small advantages. With proper checks and thoughtful use, AI is becoming less of a novelty and more of a daily part of how the market operates.

AI trading is now a part of modern investing. It powers everything from large-scale trades to small portfolio adjustments, combining speed with logic that can evolve. Human input still matters, but it's now paired with systems that process more data, faster, and with better accuracy. These tools aren't just for big firms anymore—they’re becoming available to anyone who invests. Like any technology, AI brings its own risks and unknowns, but its place in the stock market is no longer up for debate. It’s already here, shaping decisions behind the scenes.

Advertisement

A Nvidia AI-powered humanoid robot is now serving coffee to visitors in Las Vegas, blending advanced robotics with natural human interaction in a café setting

How AI in software development is transforming how developers write, test, and maintain code. Learn how artificial intelligence improves efficiency, automates repetitive tasks, and enhances software quality across every stage of the development process

How Toyota is developing AI-powered smart factory tools in partnership with technology leaders to transform production efficiency, quality, and sustainability across its plants

Discover how ByteDance’s new AI video generator is making content creation faster and simpler for creators, marketers, and educators worldwide

Delta partners with Uber and Joby Aviation to introduce a hyper-personalized travel experience at CES 2025, combining rideshare, air taxis, and flights into one seamless journey

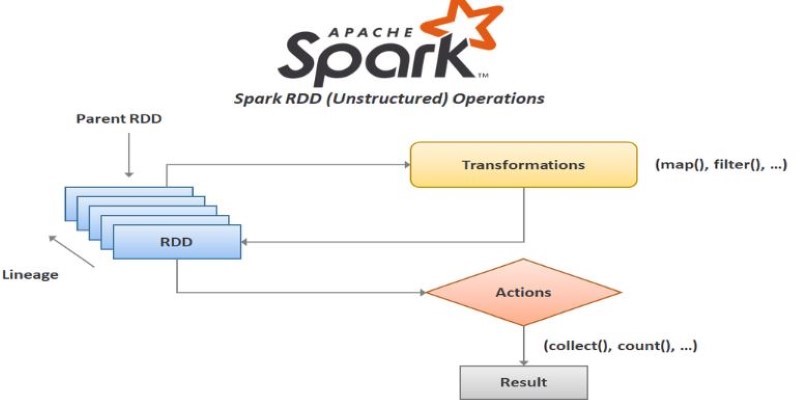

How to create RDD in Apache Spark using PySpark with clear, step-by-step instructions. This guide explains different methods to build RDDs and process distributed data efficiently

Explore the key features, benefits, and top applications of OpenAI's GPT-4.1 in this essential 2025 guide for businesses.

AI in Travel is changing the way people explore the world. Discover 19 real examples of how artificial intelligence improves planning, customer service, pricing, and personalization in modern tourism

How AI-powered genome engineering is advancing food security, with highlights and key discussions from AWS Summit London on resilient crops and sustainable farming

AI Trading is transforming the stock market by analyzing data, predicting trends, and executing smarter trades. Learn how artificial intelligence improves accuracy, manages risk, and reshapes modern investment strategies for both institutions and individual investors

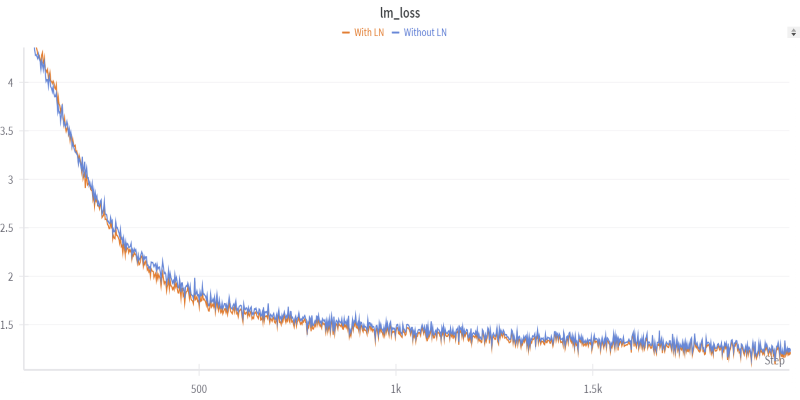

Want to shrink a large language model to under two bits per weight? Learn how 1.58-bit mixed quantization uses group-wise schemes and quantization-aware training

How to write a custom loss function in TensorFlow with this clear, step-by-step guide. Perfect for beginners who want to create tailored loss functions for their models